student loan debt relief tax credit application for maryland resident

About 9 million in tax credits will be available for more than 9000 Maryland residents with student loan debt Gov. Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents.

Student Loan Debt Relief Options When Forbearance Ends Credit Karma

Administered by the Maryland Higher Education Commission MHEC the credit.

. Instructions are at the end of this application. September 9 2019 - 704 am. For unsafe financial debts there are different alternatives such as financial debt loan consolidation.

Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents. This application and the related instructions are for Maryland residents who wish to claim the Student Loan Debt Relief Tax Credit. Applications are now being accepted for the 2019 Maryland Student Loan Debt Relief Tax Credit.

Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are. Do NOT include entire TurboTax packet entire HR Block packet IRS form 1040 form W-2 form. Student Loan Tax Credit Application.

September 2 2021 - Comptroller Peter Franchot urges eligible Marylanders to act fast and apply for the Student Loan Debt Relief Tax Credit Program for Tax. Larry Hogan announced TuesdaySince its launch in. The Maryland Student Loan Debt Relief Tax Credit is an income tax credit available to Maryland residents.

Maryland residents who have significant student loan debt may benefit from a Maryland tax credit. The Student Loan Debt. Eligible applicants are Maryland Tax Payers in 2021 who have incurred at least.

The Deadline for the Student Loan Debt Relief Tax Credit is September 15. From July 1 2022 through September 15 2022. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for.

The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education Commission. From July 1 2022 through September 15 2022. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are.

The following documents are required to beincluded with your completed Student Loan Debt Relief Tax Credit Application. Documentation from your. For unprotected debts such as charge card personal financings particular personal student car loans or various other similar a debt relief program may offer you the remedy you require.

Complete the Student Loan Debt Relief Tax Credit application. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least. A copy of your Maryland income tax return for the most recent prior tax year.

The deadline to apply is September 15th. Student loan debt relief tax credit individuals that have at least 20000 in undergraduate or graduate student loan or both debt may qualify for the credit. This application and the related instructions are for Maryland.

The good news is that there are legal solutions to aid fix your financial concerns. If you pay taxes in Maryland and took out 20K or more in debt to finance your post-secondary education apply for the Student Loan Debt Relief Tax Credit. Complete the Student Loan Debt Relief Tax Credit application.

Complete the Maryland Student Loan Debt Relief Tax Credit Application as instructedbelow. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for.

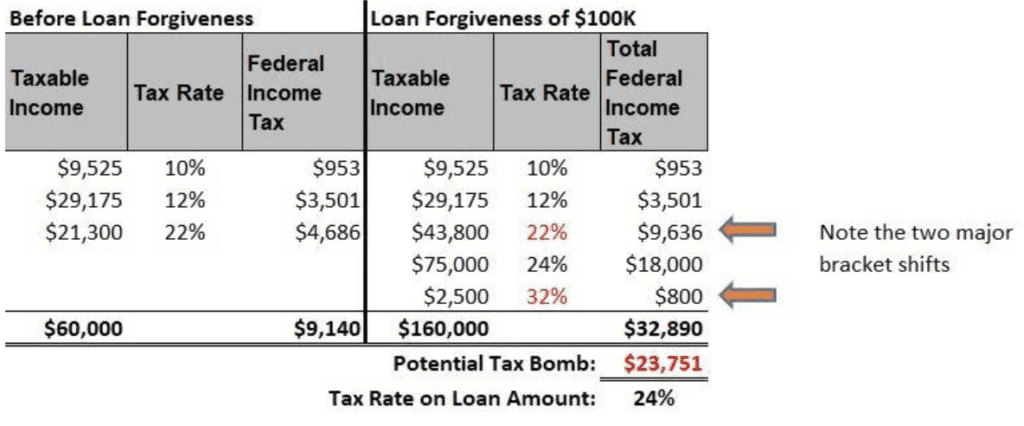

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

Biden Is Already Backtracking On His Promises To Provide Student Debt Relief Astra Taylor The Guardian

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

Maryland Student Loan Forgiveness Programs

How To Claim The Maryland Student Loan Tax Credit Fire Esquire Student Loans Debt Relief Programs Student Loan Debt

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

This State Wants To Pay Off 40k In Student Loan Debt For First Time Homebuyers

New York Debt Relief Programs Get Nonprofit Help For 2 100k

Governor Hogan Announces 9 Million In Additional Tax Credits For Student Loan Debt 47abc

Can I Get A Student Loan Tax Deduction The Turbotax Blog

This State Wants To Pay Off 40k In Student Loan Debt For First Time Homebuyers

Watch How Student Loan Debt Disproportionately Hurts Black Borrowers Pbs Newshour

Navient Student Loan Settlement Who Qualifies For Relief And What To Do

News Release Comptroller Franchot Urges Marylanders To Apply For Tax Credit

Texas Debt Relief Programs Get Nonprofit Help For 2k 100k

Learn How The Student Loan Interest Deduction Works

Governor Hogan Announces 9 Million In Additional Tax Credits For Student Loan Debt Wdvm25 Dcw50 Washington Dc