td ameritrade taxes explained

TD Ameritrade Secure Log-In for online stock trading and long term investing clients. Its not TDs choice.

We suggest you consult with a tax-planning professional with regard to your personal circumstances.

. Its showing a total loss of. LIFO last-in first-out Last-in first-out LIFO selects the most recently acquired. Taxes can impact the growth of your portfolio so its important to understand how.

File With Confidence Today. TD Ameritrade specifies the SRO requirement for each security. The tax-loss harvesting feature is currently only available with the TDAIM ETF-based portfolios in taxable TD Ameritrade Investing Accounts.

TD Ameritrade does not provide tax advice. Its an IRS rule. No Tax Knowledge Needed.

TD Ameritrades paperMoney virtual simulator is a desktop-based platform geared toward advanced and frequent traders. You cant take a loss on a stock sell until youve been out of the stock for more than 31 days. Ad The Industry-Wide Leader in Mobile Trading.

The SRO is as low as 30. How to Fight and Waive Fees at TD Ameritrade. TurboTax Makes It Easy To Get Your Taxes Done Right.

Tax Divorced in November 2020. This is not an offer or solicitation in. Sign Up from Your phone.

Tax-loss harvesting is not appropriate for all. How Ive had it explained to. We suggest you consult with a tax-planning professional with regard to your personal circumstances.

This document will provide instructions on how to view an accounts cost basis to determine unrealizedrealized gainslosses. For example for long marginable equities priced over 1 the SRO is 25 percent. TD Ameritrade does not provide tax advice.

TD Ameritrade Investment Management LLC TDAIM offers automated tax-loss harvesting in its ETF-based portfolios held in taxable accounts at no extra cost Introduction Many investors. TD Ameritrade Hidden Fees If youre concerned about hidden fees that TD Ameritrade charges keep reading because youre going to dig deep into its pricing schedule analyze and explain. No Tax Knowledge Needed.

Have a joint statement from TD Ameritrade where all of the stocks were liquidated and then the cash split up. How to see gains loses W Td ameritrade 2 min Facebook. Or qualified foreign corporation.

TD Ameritrade Investment Management LLC TD Ameritrade Investment Management and its affiliates do not provide tax advice. TD Ameritrade - Capital Gains Taxes. TurboTax Makes It Easy To Get Your Taxes Done Right.

There are two types of capital gains. John Ricketts founded Ameritrade in 1971 and today the broker and online trading platform boast 11 million clients over a trillion dollars and. One of the main ways to profit from investing is to buy assets at one price and then sell them at a higher price.

They just have to track it. Ad The Industry-Wide Leader in Mobile Trading. Ad Answer Simple Questions About Your Life And We Do The Rest.

Ad Answer Simple Questions About Your Life And We Do The Rest. We suggest you consult with a tax. It provides 100000 in practice money along with.

Please consult a tax advisor regarding your personal situation. Sign Up from Your phone. TD Ameritrade will report a dividend as qualified if it has been paid by a US.

TD Ameritrade does not provide tax advice. These types of profits are known as capital. This is not an offer or solicitation in.

File With Confidence Today. Holding period requirements that must be met to be eligible for this lower tax rate.

See Your Allocations From The Inside Out With Portfol Ticker Tape

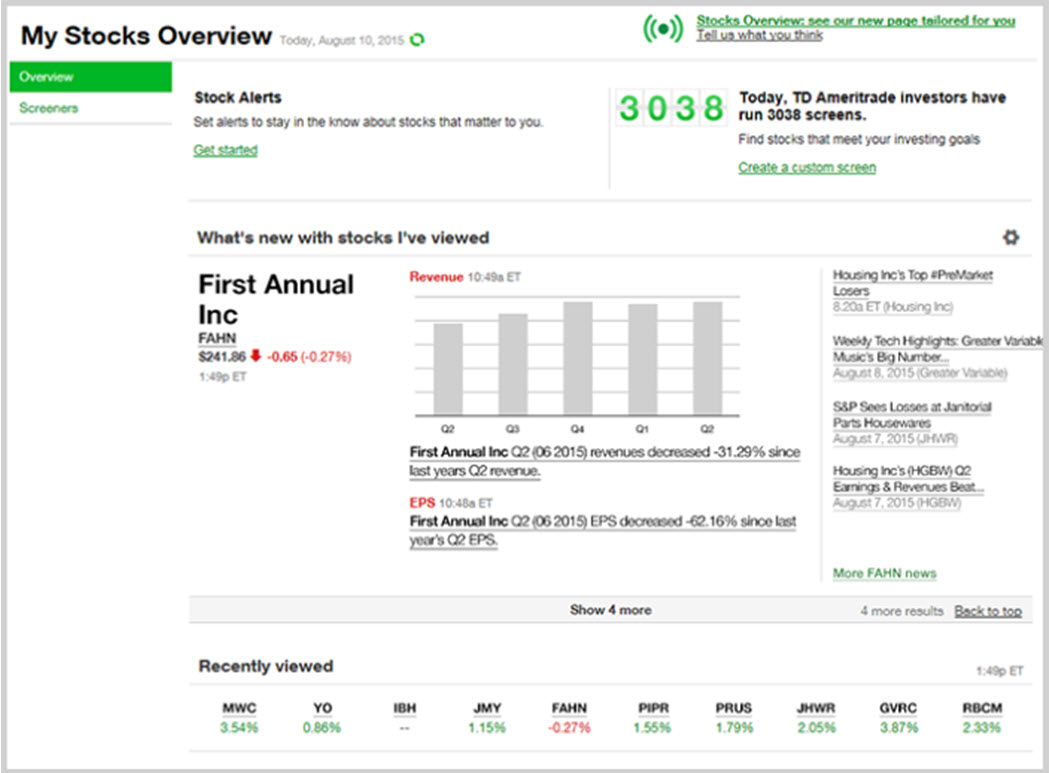

3 Reasons To Visit Stocks Overview Every Market Day Ticker Tape

Td Ameritrade Review 2021 Real Estate Millions

Td Ameritrade Review 2022 Pros And Cons Uncovered

How To Transfer Assets To Td Ameritrade Youtube

.png)

Tax Loss Harvesting Wash Sales Td Ameritrade

2022 Td Ameritrade Review Pros Cons Benzinga

Coinbase S Path To Creating A Robust And Regulated Crypto Derivatives Market In 2022 Derivatives Market Derivatives Trading Offer

Td Ameritrade Review 2022 Pros Cons And How It Compares Nerdwallet

Td Ameritrade Review My Experience Using Td Ameritrade

Strategies Rules For Capital Gains Tax On Investments Ticker Tape

2022 Td Ameritrade Review Pros Cons Benzinga

Strategies Rules For Capital Gains Tax On Investments Ticker Tape

Learn How To Place Trades And Check Orders On Tdameri Ticker Tape

/td_ameritrade_productcard-5c61ed44c9e77c000159c8f6.png)

/Robinhoodvs.TDAmeritrade-5c61bba946e0fb0001587a6f.png)

/TD_Ameritrade_Recirc-97600f27bf3b427eba91b3218de8038e.jpg)